Condo Insurance in and around Austin

Austin! Look no further for condo insurance

Cover your home, wisely

Your Search For Condo Insurance Ends With State Farm

As with any home, it's a great idea to make sure you have coverage for your condo. State Farm's Condo Unitowners Insurance has terrific coverage options to fit your needs.

Austin! Look no further for condo insurance

Cover your home, wisely

Why Condo Owners In Austin Choose State Farm

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has dependable options to keep your condo and its contents protected. You’ll get coverage options to match your specific needs. Thank goodness that you won’t have to figure that out alone. With empathy and terrific customer service, Agent Steve Justice can walk you through every step to help generate a plan that shields your condo unit and everything you’ve invested in.

Finding the right insurance for your condominium is made easy with State Farm. There is no better time than today to call or email agent Steve Justice and explore more about your fantastic options.

Have More Questions About Condo Unitowners Insurance?

Call Steve at (507) 437-4447 or visit our FAQ page.

Simple Insights®

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

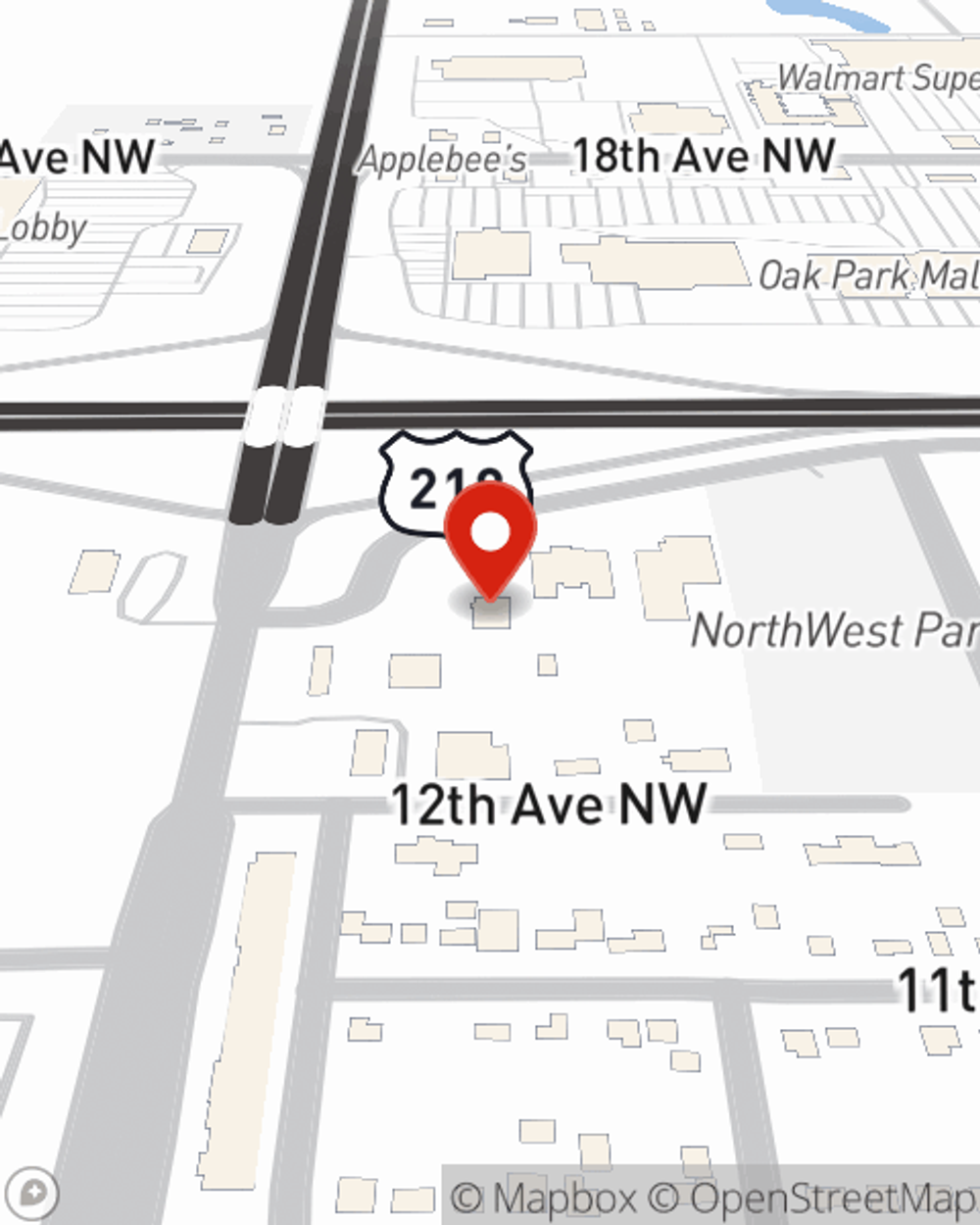

Steve Justice

State Farm® Insurance AgentSimple Insights®

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.